What Happens When Neighborhood Pharmacies Close

Retail pharmacies are in crisis. Over the past four years, the three largest drugstore chains — CVS, Rite Aid, and Walgreens — have closed almost 3,000 locations nationwide, according to the 2025 Economic Report on U.S. Pharmacies and Pharmacy Benefit Managers.

In Greater Boston, nearly 15,000 residents live in pharmacy deserts, sections of the city where a drugstore is at least a half-mile away and the majority of people do not have cars.

The impetus for those closures is complicated, spurred by a maelstrom of economic and workflow factors reshaping the pharmaceutical landscape. Drugs are still big business. In 2024, total prescription dispensing revenues for retail, mail, long-term care, and specialty pharmacies reached $683 billion, excluding COVID-19 vaccines. But the delivery model is changing fast, leaving consumers confused and priced out.

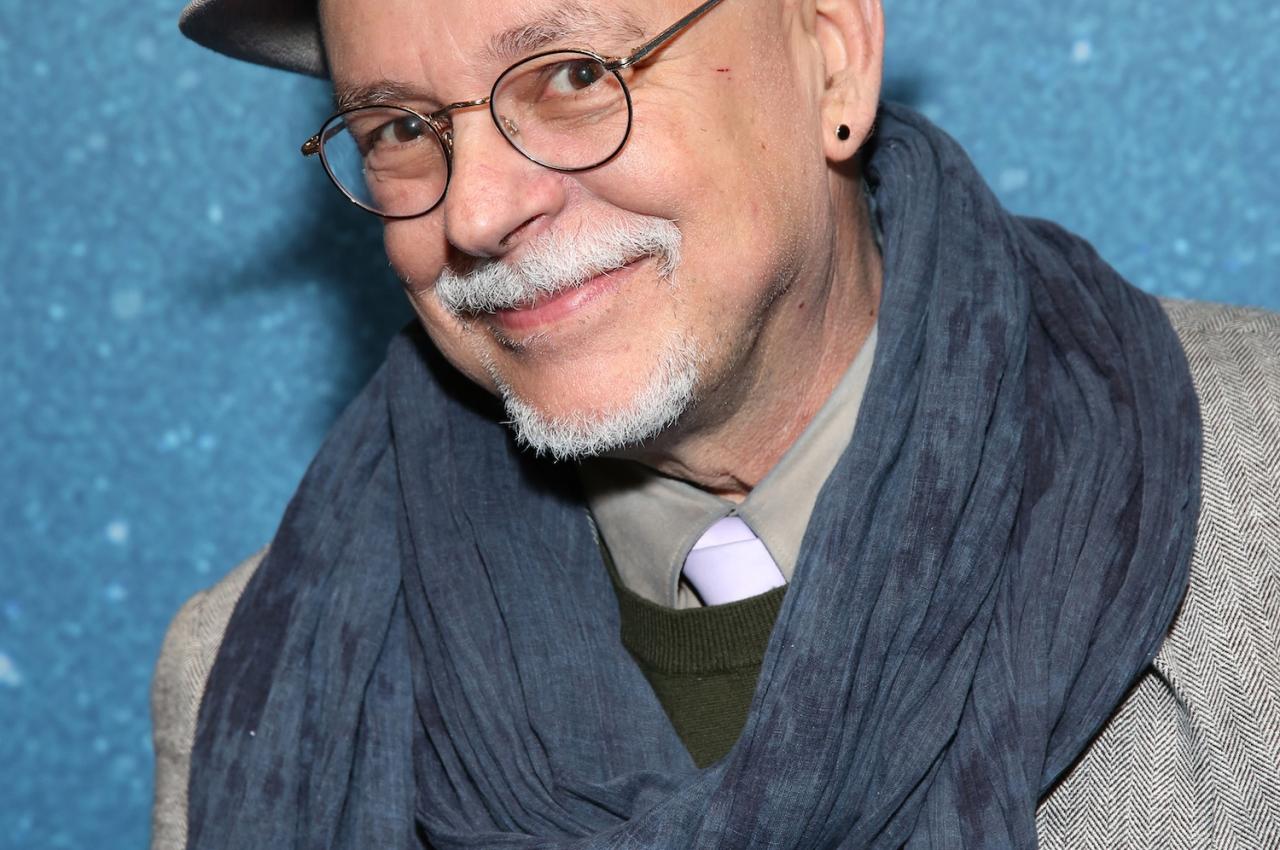

“So much has been going on behind the scenes. The story is really about the story ‘behind’ the story. But what people are seeing is that, all of a sudden, there’s a closing. A sign goes up on the window, and that’s it. There’s no consideration for the consumer in that regard,” says Paul Beninger, professor in the Department of Public Health and Community Medicine at Tufts University School of Medicine.

If you’re struggling with rising drug prices, or simply lamenting the closure of your neighborhood Rite Aid, here’s what Tufts experts want you to know about why this is happening and what you can do.

Staffing Challenges

At large national chains, staffing is a persistent obstacle.

“There’s a shortage of trained new pharmacists entering brick-and-mortar pharmacies, and a lot of the pharmacists that worked in many of those chains are aging out now,” says Kenneth Getz, executive director of the Tufts Center for the Study of Drug Development. “Newer pharmacists are moving into higher-paid jobs in adjacent areas, including pharmaceutical trade. There’s more competition for people with pharmacology training.”

“A number of pharmaceutical companies have essentially pledged to give approved therapies to patients who can’t afford to pay. Almost every major and mid-sized company has a patient-access program for patients who can demonstrate that they have no or very little disposable income.”

Online Giants and Telehealth Platforms

The rise of online pharmacies, offering convenience and budget-friendly pricing, is another threat to the traditional retail model.

“You have all kinds of web-based and mail-order approaches that cut out some of the markup and the middleman, creating a lot of economic and competitive intensity in the marketplace,” Getz says.

On one end of the spectrum, there are giants such as Amazon and Walmart, which “can give retail pharmacies a run for their money, because they have a lot of advantages: They have remarkable inventory control, they have leverage, and they can get preferred pricing—so they can compete on price,” Getz says.

There are also newer telehealth services that often offer wraparound-care business models and non-brand-name, compounded, lower-priced drug alternatives to, for example, GLP-1 weight-loss medications.

“Some of these organizations have found unique ways to develop and sell a compound at a much lower price, and they already have established infrastructure. They may have physicians on call, using video to interact with and oversee a patient’s care,” Getz explains.

Online convenience is tempting, but not every upstart company plays by the rules. Some sell unregulated supplements or non-FDA-approved drugs.

“It’s the Wild West in the sense that there are clearly players that have cut corners. There are others that have tried to do everything right and follow a set of quality standards. They claim to offer a certain level of integrity, and they have federal regulations and policy behind them,” Getz says. “But a consumer has to be careful, do their homework, and vet these organizations. If it’s too good to be true, there’s a good chance that they’re cutting a corner.”

Prescription drugs are big business. In 2024, total prescription dispensing revenues for retail, mail, long-term care, and specialty pharmacies reached $683 billion. Photo: Shutterstock

Supply Chain Control Issues

Pharmacy benefit managers (PBMs) undercut the retail model. These third-party administrators act as middlemen who liaise between insurance companies, patients, and manufacturers. PBMs work directly with private insurers. By controlling and consolidating every aspect of the supply chain—called vertical integration—some pharmacies are iced out.

The three largest PBMs in the United States are CVS Caremark, Cigna Express Scripts, and UnitedHealth Group’s Optum Rx. About 80% of PBM business goes through these three organizations. That can mean affiliated pharmacies get better deals or faster access, while others struggle.

A recent analysis by the American Medical Association highlights the low competition among PBMs and high tendency to be integrated with health insurance companies, which are conditions that pose significant financial risk for patients.

“What’s happened is that companies like Rite Aid have been suffering because of the competitive forces against them and losing small percentages of sales. Not being part of a larger integrated ecosystem has left them off to the side,” Beninger explains.

Pharmacy Bypass Routes

Retail business is also undercut by the rise of online and mail order pharmacies, which streamline the delivery channel and, as a result, can provide discounted rates.

Finally, some patients simply opt not to fill prescriptions due to cost.

“We hear so many stories of people who have to choose between being able to purchase food for their family or to pay for their medication. They often choose food for their family. There are certain therapies where the prices are so high now that unless someone has the appropriate insurance coverage, there’s virtually no way they can get access to that therapy,” Getz says.

These unaffordable drugs typically target rare diseases through cell and gene therapies. They are expensive to manufacture, Getz explains, and the markets are so tiny that manufacturers need to recoup their research-and-development costs with higher prices.

“What people are seeing is that, all of a sudden, there’s a closed pharmacy. A sign goes up on the window, and that’s it. There’s no consideration for the consumer in that regard.”

How Patients Can Take Control

There is a bright side. Getz is monitoring the rise of clinical trials as a way for patients to access investigational and potentially life-saving therapies.

“We’re starting to see growing patient interest in trials as a way to gain access to a therapy without having to get an insurance provider behind it,” he says. In this case, direct patient-access programs offer a streamlined manufacturer-to-patient pipeline.

“A number of pharmaceutical companies have essentially pledged to give approved therapies to patients who qualify, who can’t afford to pay. Almost every major and mid-sized company has a patient-access program for patients who can demonstrate that they have no or very little disposable income,” Getz says.

And, while the landscape might appear stacked against the average consumer, Getz also sees grassroots promise in the patient advocacy sector.

“The important message is that patients and their families are not alone. There are many options, and with the right network of support, you can find ways to navigate this incredibly intense, at times really discouraging, environment,” he says. “Some organizations, such as the Cystic Fibrosis Foundation or the Michael J. Fox Foundation, are totally keyed into pharmacy chains that may be struggling to carry a certain type of therapy and will negotiate with other channels to make sure that a certain percentage of patients with a disease can gain access to that therapy.”

Finally, Beninger urges patients to consult with their physicians, who can offer a clinical, longer-range perspective about drug access and costs.

“The best-informed person is your family physician. Don’t ask them ‘yes’ or ‘no’ questions. Ask: ‘Where does this product fit in the scheme of products that someone in my insurance situation can have access to?’ There are expensive new products, and there are generic products that are a generation or two older that are inexpensive. That’s where you need to be informed. Your clinician can tell you the range of treatments available, and a physician increasingly needs to take this into account when they write a prescription.”