What’s the Federal Reserve and Why Is Its Independence Important?

The Federal Reserve Bank has been in the news lately not because of its decisions about monetary policy, but because of the controversy over President Trump’s criticism of its chairman, Jerome Powell, and his efforts to fire Board Governor Lisa Cook. Trump wants the Federal Reserve to lower interest rates, arguing it would boost the economy.

But Powell and the Fed’s Board of Governors say they value and guard their independence, and make their decisions based on what they believe is best to foster economic growth and stability, rather than politicians’ preferences.

“There’s a lot of both theoretical and empirical work that shows that when countries have more political influence over monetary policy, there tends to be higher inflation and no improvement in employment,” says Michael Klein, William L. Clayton Professor of International Economic Affairs at The Fletcher School.

Klein is also executive editor of EconoFact, a nonpartisan publication on economic and social policies. He took a leave of absence from Tufts to serve as chief economist in the Office of International Affairs at the U.S. Treasury from 2010 to 2011.

Tufts Now recently spoke with Klein about the Federal Reserve and its independence.

What is the Federal Reserve, and what does it do?

The Federal Reserve is the country’s central bank. It was created by the Federal Reserve Act in 1913, a response by Congress to a series of banking and financial crises in the prior decades. The Fed sets monetary policy primarily by determining a short-term interest rate—the Federal Funds Rate—which then affects other interest rates that determine the cost of borrowing for consumers, businesses, and the government.

The Federal Reserve was set up to be independent of the political process—it is not part of the executive, legislative, nor judicial branches. The Board of Governors of the Federal Reserve in Washington, D.C., employs about 500 Ph.D. economists. There are also 12 regional Federal Reserve Banks around the country in cities like Boston, New York, Richmond, San Francisco, and St. Louis.

The Federal Reserve’s Open Market Committee meets every six weeks. At these meetings, the members of the Board of Governors and five of the 12 regional Federal Reserve Bank presidents vote on interest rate policy. The president of the Federal Reserve Bank of New York is always a voting member, and the other four voting slots rotate among the presidents of the other regional Banks.

Why is the Federal Reserve an independent government entity?

The interest rate decisions of the Federal Reserve are meant to be insulated from politics so they reflect the best economic prescription for stable prices and robust employment, not the desire of politicians who might want to stimulate growth in advance of an election. It’s the same logic that is meant to insulate the judicial branch from Congress and the president—legal decisions should be based on the law, not politics.

Empirical analyses demonstrate the importance of the independence of central banks. Countries whose central banks are more insulated from politics, for example by having long terms for their governors, tended to have lower inflation and no worse unemployment than countries whose central banks were more subject to political pressure. That is why economists are concerned with the president’s attacks on the independence of the Federal Reserve—political pressure could lead to higher inflation and a destabilization of the economy.

This isn’t the first time a president tried to pressure the Federal Reserve, is it?

President Nixon, in the run-up to the 1972 election leaned on Federal Reserve Chairman Arthur Burns to ease monetary policy. Nixon was very worried about a recession hurting his chances of reelection—he blamed the economic slowdown in 1960 for his loss to John Kennedy in a very close election. Evidence shows that Nixon’s pressure to lower interest rates in advance of the 1972 election helped spur inflation.

Then the Federal Reserve under Paul Volcker hiked interest rates and tackled inflation. Did that become a lesson for the central bank?

Volcker’s policy choices were very unpopular at the time they were implemented in 1979 and 1980, but they broke the back of the inflationary cycle of the 1970s and set the stage for sustained growth with low inflation. This demonstrated the importance of the independence of the Federal Reserve, and that experience, as well as economic theory and empirical analyses, set the stage for legislation that made central banks across the globe more insulated from politics.

This has contributed to lower inflation since the early 1980s, not only in the United States but across the world. With greater independence, central banks were not forced to finance government debt or bend to politician’s desires, but could make decisions based on good economic analysis on how to stabilize the economy.

What’s a recent example of the failure of central bank independence, and the consequences of that?

Turkish president Recep Erdoğan took political control of his nation’s central bank over the past few years, keeping interest rates low even as inflation heated up. Erdoğan wanted lower interest rates because that would help promote investment and consumption of big-ticket items. But the consequence was even higher inflation. This was not the case of boosting an economy before an election, but of a sitting leader wanting to control the economy through pressure on the central bank. But it didn’t end well.

President Trump has also mentioned how lower interest rates would help lower the government’s interest payments on the national debt. What is the link between monetary policy and fiscal policy?

When the government runs a budget deficit, it sells bonds to pay its creditors. The bonds can be bought either by the public or by the central bank. When the central bank purchases bonds, it uses money that had not been in circulation—so the money supply increases with what is called the “monetization of the deficit.”

To limit this possibility, countries have a firewall between their treasury or finance ministry, which collect tax revenues and pay for government goods and services, and the central bank, which controls the supply of money and interest rates.

A central bank controlled by the executive branch could be prone to monetize the government’s budget deficits as a way to avoid the more transparent cost of raising taxes. This leads to inflation, which is itself a kind of tax.

There are a number of examples of this. Argentina has had persistent economic crises because they ran big budget deficits financed by printing money. One of the most dramatic and famous examples is the German hyperinflation of the 1920s. Germany had to make large reparation payments, which were seen as illegitimate within Germany, and it was very hard for the government to tax to pay those.

So the German central bank printed money to make payments, which led to runaway hyperinflation. You can trace the defeat of Germany in 1918 and the subsequent hyperinflation and economic instability of the 1920s directly to the rise of fascism and, ultimately, to World War II.

Latest Tufts Now

- Cheese Fungi Help Unlock Secrets of EvolutionColor changes in fungi on cheese rinds point to specific molecular mechanisms of genetic adaptation—and sometimes a tastier cheese

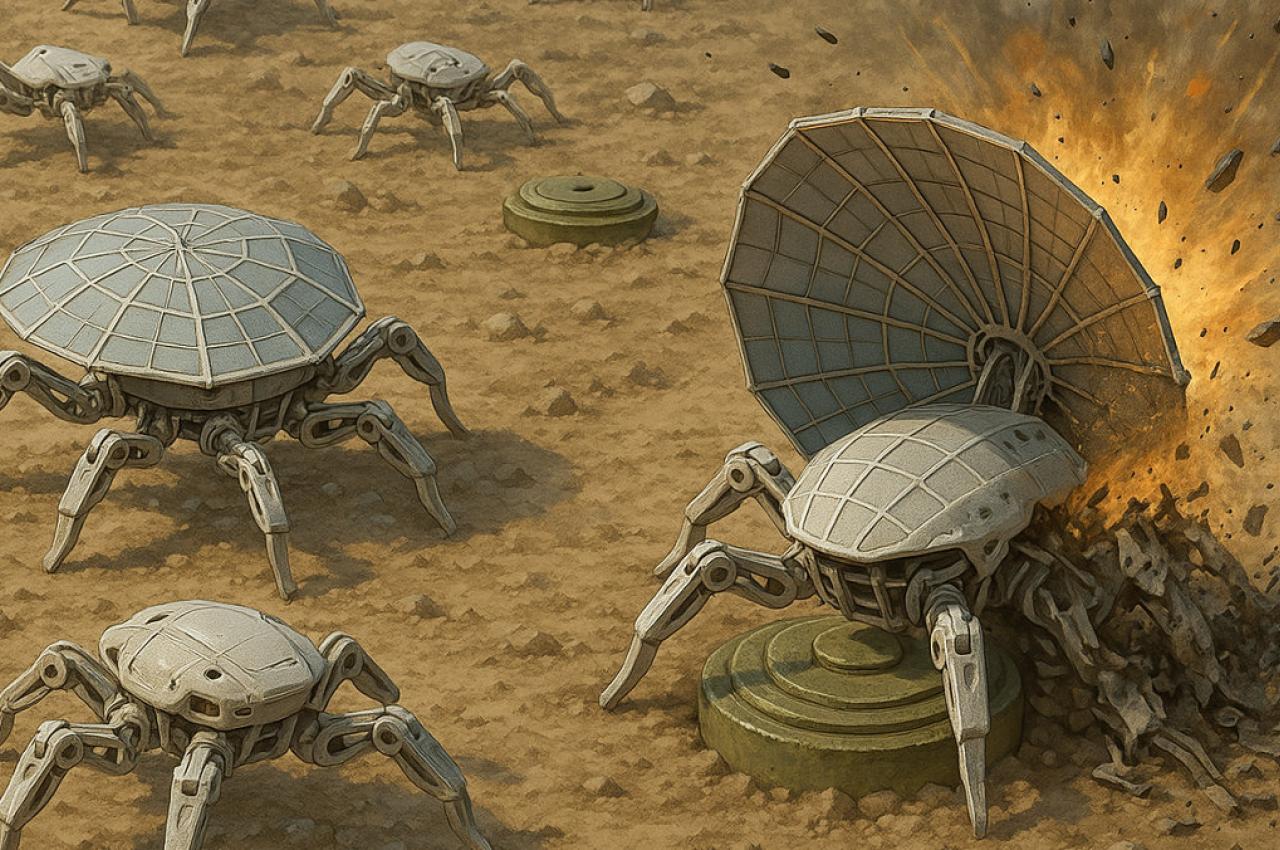

- Crab-Inspired Robot Development Moves Forward with New GrantMulti-legged robots could be manufactured at low cost, capable of learning on land and underwater for tasks such as landmine clearance

- Daniela Koplin’s DNA MatchmakingInspired by her grandmother—a pioneering genetics researcher—the senior has helped connect cancer patients with potential stem-cell and marrow donors at Tufts

- Tufts Launches University-Wide Training Series on Civil Rights ProtectionsNearly 100 sessions will be made available to accommodate all faculty, staff, and affiliates at the university

- Tufts’ Fulbright Fellows Embark on Global Journeys of DiscoveryEight Tufts alumni participating in the Fulbright U.S. Student program reflect on what they hope to learn from working and living outside of their home country

- Tufts Will Be Tuition-Free for U.S. Families Earning Less Than $150,000With the Tufts Tuition Pact, the university underlines its commitment to reducing financial barriers for its undergraduates